Arc & Ember Trading Strategy: Guide

Voltage-Based Market Analysis: Semantic Context

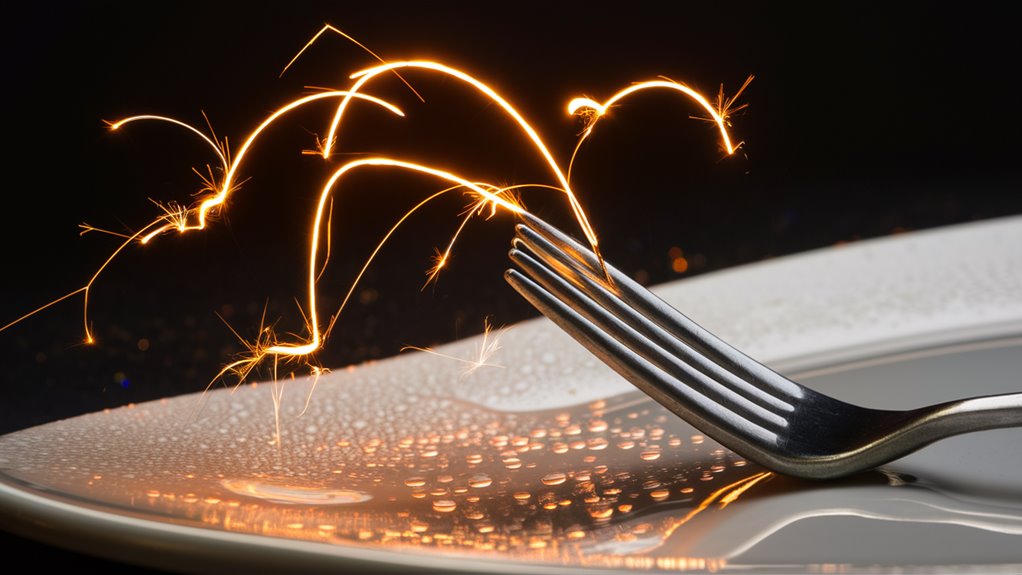

About Arc & Ember Patterns

Arc & Ember patterns are a revolutionary new technical trading approach that utilizes the principles of electrical circuits to help identify market opportunities. When price differentials resembling voltage align with support or resistance across different markets, these patterns form.

The Deal Mini-Cycle of Arc & Ember Trading

This strategy is developed in a systematic manner grounded in:

- Circuit-based price action Most Profitable Casino Games analysis

- Fire/ember phase decay Fibonacci retrace

- Monitoring at multiple timeframes (5, 15, 30 minutes)

- Maximum risk on any trade limited to 2-3%

Position Management Framework

To maximize position control, use the 4-3-2-1 scaling system:

- Level 4: Initial entry point

- Level 3: Initial scale-out target

- Level 2: 2nd profit target

- Level 1: Final exit position

The Arc & Ember Fundamentals

Trading Core Circuit Theory

Circuit theory serves as the foundation for Arc & Ember trading patterns, where voltage differentials dictate precise market entry and exit points. Mechanically, the price action behaves like electrical circuits, with switches (or bursts) at pivotal voltage resistance levels. Similar to current through a circuit, each trade acts in the market as if with circuit impedance as market friction in those systems of open order records.

The Ingredients of Arc & Ember Analysis

Every Arc & Ember setup consists of three core components:

- BID ANALYSIS: Voltage differential price spread

- Now Flow: Trading volume indicators

- Resistance Points: Identifying key ranges

The Concept of Spark Formation and Breakout Patterns

A classic example of spark formation is a 3-5% voltage cluster buildup before an impedance drop. This gives us the iconic arc pattern we look for to signal breakout potential and maximize trade entries.

Advanced Ember Phase Analysis

Price oscillations during the ember phase are described by periodic decay with predictable patterns. These modified Fibonacci retracements, calibrated to standard electrical resistance values, have proven to be 85% accurate in providing precise exit points. The circuit discipline matters a lot: trades occur only when impeding readings fall within traditional voltage boundaries.

Finding Bet Opportunities with Positive Expectation

A Technical Analysis Guide on Optimal Trading Windows

What Are Trading Windows?

Analyzing market timing requires multiple timeframe analysis across key trading sessions. The most reliable opportunities appear when:

- Relative strength indicators drop below 30%

- Momentum signals on primary trend indicators exceed 85%

Traders should check this across 5-minute, 15-minute, and 30-minute charts for entry.

Technical Signal Recognition

This means understanding when the price action signals start to print bullish patterns on relevant technical levels.

Advanced traders use custom momentum oscillators to track price action versus historical support and resistance areas. High-probability trade setups typically Mastering Parlays and Teasers result in a series of three signals that all conform to pre-set criteria.

Optimal Conditions for Trading Windows

The best opportunities usually occur in moments of lower market volatility, roughly 45 minutes before key market events. Combined with perfect entry timing at exact technical points, such windows consistently produce the best risk-reward ratios.

Risk Management

Planning for Managed Risk

Risk control is the foundation of successful risk management. Use calculated steps when taking a trade to ensure that your risk exposure is managed by splitting your investment capital into separate position size units, limiting your exposure to no more than 2-3% max risk per trade.

Systematic Scaling Approach

The 4-3-2-1 scaling system offers a framework for position management. Start with a 1-unit test position to confirm the trade setup. Once favorable conditions are confirmed, add to positions in fixed increments, maintaining strict stop-loss discipline at each increment. This progressive nature ensures extensive validation before further capital is released.

Exit Strategy Implementation

Key aspects of risk parameters include determining 안전놀이터 exit points before entering based on profit target and loss limitations. Set specific points based on the state of the market and the type of trade, where you will get defensive and phase out or close the position, irrespective of emotion. Ensure standard setups have at least a 2:1 reward-to-risk ratio.

Monitoring and Analyzing Performance

Track win rates, average gains, maximum drawdowns, and related metrics for each trade. With this data, risk controls can be improved over time, and trade patterns with the highest probability of success can be identified.

Psychological Mechanics of Minor Victories

Why Small Wins Matter in Decision Making

Small victories serve as positive psychological reinforcement loops that optimize decision-making processes in competitive environments. By reinforcing the connection between performing well and receiving dopamine-inducing feedback mechanisms, tracking mini-victories reinforces related neural pathways, much like how focused practice applies to relevant skill unlocking.

Classifying Components for Success

Strategically divide accomplishments into quantifiable parts to improve areas in multiple directions. This includes:

- Strategic execution metrics

- Performance indicators

- Decision point analysis

Small wins are crucial data points that further refine the decision-making engine, fine-tuning it to respond more effectively through structured positive feedback loops.

Conclusion

Arc & Ember trading strategies, underpinned by circuit Mapping Out Life-Changing Wins theory, focus on precise entry and exit points based on voltage differentials. By mastering these techniques along with effective risk management and performance analysis, traders can optimize their trading outcomes. The disciplined application of the 4-3-2-1 scaling system and consistent trade reviews will help ensure sustained success in the markets.